Premise :

you are sitting on a sofa chilling with a coke can in hand, and all of a sudden your uncle X, who is a LIC agent rings the doorbell, he knows you have started earning!

what to do now?

- run for life, make an excuse, nope after reading this article you would take on the challenge of being an adult 😭

why read this?

after reading this, would have enough financial 101 concepts to take on a challenge and problem-solve on your own!

Plus some browny points from me ❤️

What is an endowment Plan?

An endowment plan is a type of life insurance policy that provides a combination of insurance coverage and savings. It pays out a lump sum of money at the end of a predetermined term, or upon the death of the policyholder, whichever occurs first. The premiums paid on an endowment plan are invested by the insurance company, and the returns earned on these investments are used to generate the lump sum payout. Endowment plans are often used to meet long-term financial goals or to provide for a spouse or children after the policyholder's death.

For example : Aditya Birla Capital has these types of endowment plans.

can you explain simply ?

Endowment Plans are Life Insurance Policies that combine 2 goal into 1. So these big AMCs came up with Endowment Plans in this way :

Iteration 1: Term Insurance

- [Goal : If you die within Y years, you get a lump sum]

Iteration 2: Money Back Plans urf Endowment Plans

[AMCs thinking: Users are getting greedy, how should I sell Term Insurance? They don't want to shell out their hard-earned money right now, else want something that can give money back in case they are still alive.]

So Endowment Plans give 2 things :

Maturity Benefit [If you are alive]

Death Benefit [pretty evident !]

what happens in real life?

Your Uncle X will share a whole lot of policies <endowment plans>, usually in the range of 10s or 15s, and then your family makes this a daily discussion as responding to uncle X with logic is necessary. <Paste Same Adulting thingy !>

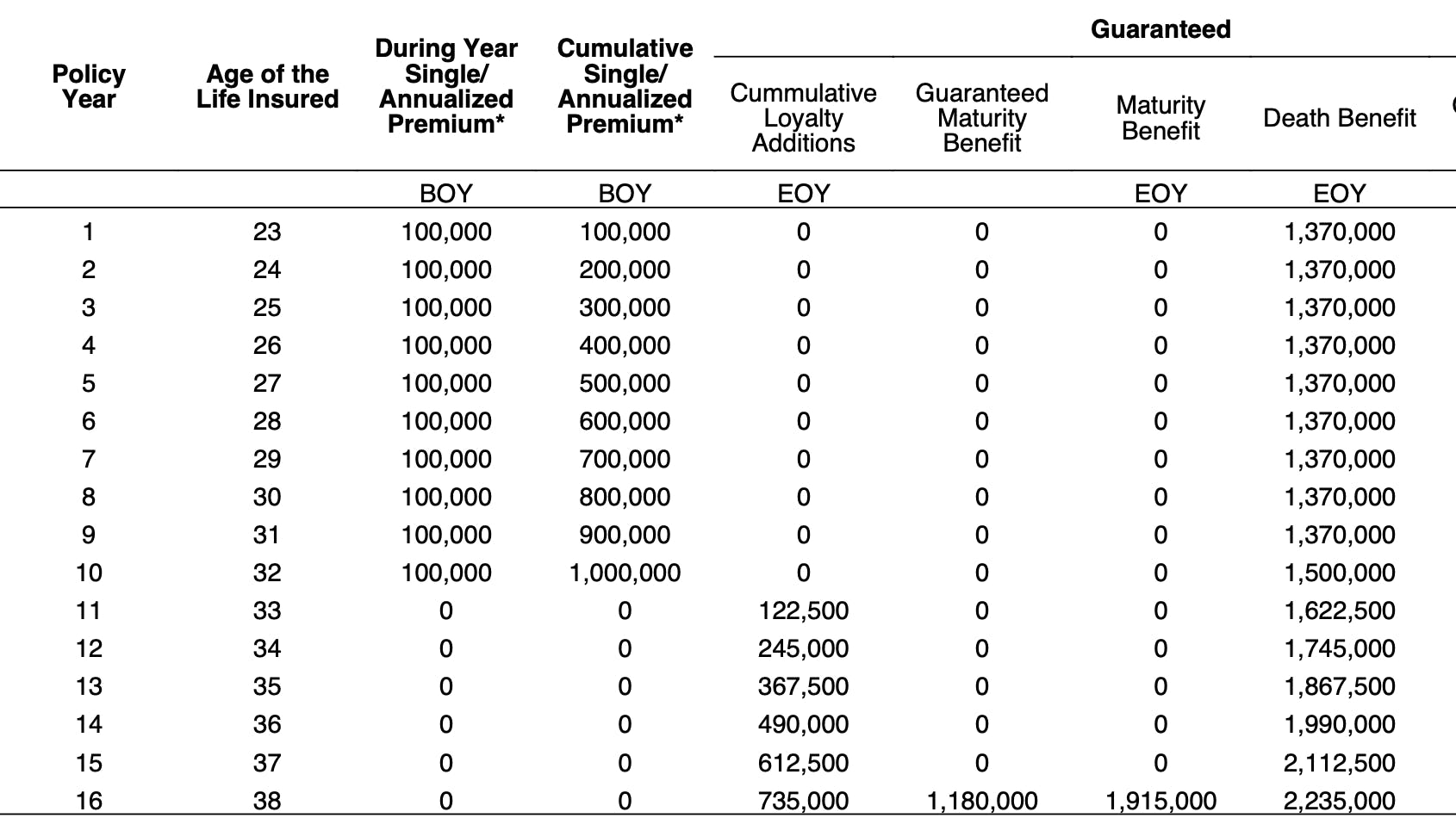

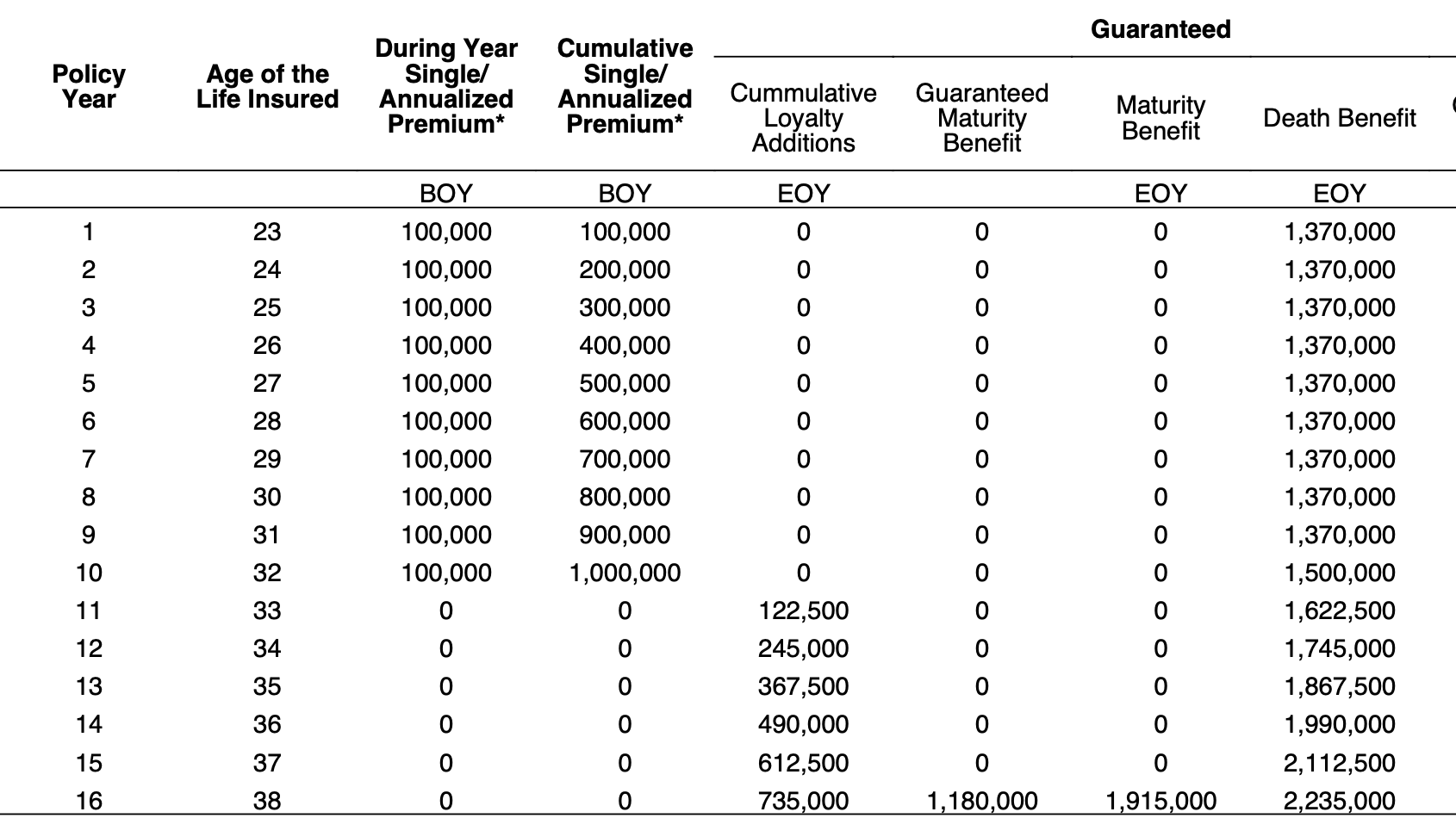

And the policy has a big table that has incoming and outgoing cashflows, now the question becomes how to differentiate a policy X from its peer groups: {policy Y, policy Z, policy A, ...}

Example of the table :

Policy Term : 16 years

Premium Payment : 1L per year for 10 years <Note : Beginning of Year\>

Payout : 19.15L in 16th year <Note : End of Year\>

Finance 101 :

How to make sense of these cashflows? Can I get a single metric that I can put my decision on?

Incoming IRR :

In finance, Internal Rate of Return (IRR) is a metric used to estimate the profitability of an investment. It is essentially the rate at which the net present value (NPV) of future cash flows is zero. NPV is calculated by summing up the discounted future cash flows and subtracting the initial investment.

More details here : https://www.investopedia.com/terms/i/irr.asp

NPV ?

Net Present Value is the sum of all cashflows both positive and negative that understands the time value of money, so these are discounted in nature.

from typing import List

def get_npv(cashflows : List[float], discount_rate : float) -> float:

npv = 0

for i in range(len(cashflows)):

npv += cashflows[i] / (1 + discount_rate) ** i

return npv

if __name__ == "__main__":

print(get_npv([-100000, 20000, 20000, 20000, 20000, 20000], .07))

what's the flow ?

Take a policy X and find it's IRR, which makes your NPV = 0, this means that the net present value of the investment that you're going to make is 0.

Q : Why should I take a deal with NPV equals 0, shouldn't this be +Ve ?

A : It means that you will make neither more nor less than the rate of return on your investment that is implied by your discount rate. And by taking a deal with maximum discount rate, you will optimize your riches.

For all policies : {policy X, policy Y, policy Z, policy A, ...} find the maximum IRR and pitch it in front of yout FD rates.

If the policy is giving close to FD rates <post tax> can take the policy with maximum IRR, as it is giving your Death Benefit which can be seen as an added rider in case some mishap.

explaining with an example :

Pointers <Policy be like> :

Give me 1L in the beginning of each year for 10 years.

I will give you 19.15L in best case scenario at the end of 16th year; rephrasing : beginning of 17th year.

Note : Calculating IRR by doing maths with pen and paper is not possible, atleast I don't know a method, so lets use code to do this instead !

from typing import List

# Finds NPV from a list of cashflows and discount_rate

def get_npv(cashflows : List[float], discount_rate : float) -> float:

npv = 0

for i in range(len(cashflows)):

npv += cashflows[i] / (1 + discount_rate) ** i

return npv

# Finds derivate of a function X at some point r.

def f_d(X, cashflows : List[float], discount_rate : float) -> float:

h = 1e-6

return (X(cashflows, discount_rate + h) - X(cashflows, discount_rate - h)) / (2 * h)

def root_finder(cashflows : List[float], start_root = 0.15, eps = 1e-6):

while True:

new_root = start_root - (get_npv(cashflows, start_root) / f_d(get_npv, cashflows, start_root))

if abs(new_root - start_root) < eps:

break

start_root = new_root

return start_root

if __name__ == "__main__":

cashflows = [0 for _ in range(17)]

# 1L payouts

for i in range(10):

cashflows[i] = -100000

# 19.5L payin

# In beginning of 16th year

cashflows[16] = 1950000

# Result : IRR for this policy is : 5.86

print(f"IRR for this policy is : {round(root_finder(cashflows=cashflows) * 100, 2)}")

Result :

5.86% is what this policy is giving out, note life insurance is tax exempted under Sec 10(10d) so you won't have to pay taxes like on FD on payout.

FD gives 7.5% right now, post tax around 6% for me.

Verdict :

I could take this policy as it gives a life cover for same rate that FD is paying me.