How to read and interpret a Term Life Insurance Document?

(With a real example)

Photo by Juliane Liebermann on Unsplash

Policy Name : HDFC Life Click 2 Protect Life

Page 1 Explained :

- Policy Type : A Non-Linked, Non-Participating, Individual, Pure Risk Premium/Savings Life Insurance Plan

- Reading the text in small

- Settlement of Claim would be subject to declaration of all pre-existing medical conditions at the time of policy purchase, and in accordance to T&C.

- The 25 ruppee premium accounts to 9214 ruppee annually for a very specific type : Life Protect Option, Male, Non-Smoker, 25 years old, Policy for 30 years(that is will close at 55), Regular Payer, Annually payouts made, exclusive of Taxes

Page 2 Explained :

Key Features :

- 3 Plan Options(Life and CI Rebalance, Life Protect, Income Plus), more about this in the new section.

- Cover for Whole Life (read provide cover till I die, Under Life Protect Plan and Income Plus only)

- A possible Return of Premium Option(read give me back all the money, I have given to HDFC).

- Waiver of Premium upon critical Illness(Assume you got cancer which is a critical illness, HDFC will not take any new premiums from this year onwards, but it is hard to convince both the parties doctors and HDFC.

- Accident Death Bonus(An extra token money if you killed in a road accident, FYI : every 4 mins in India, a road accident happens)

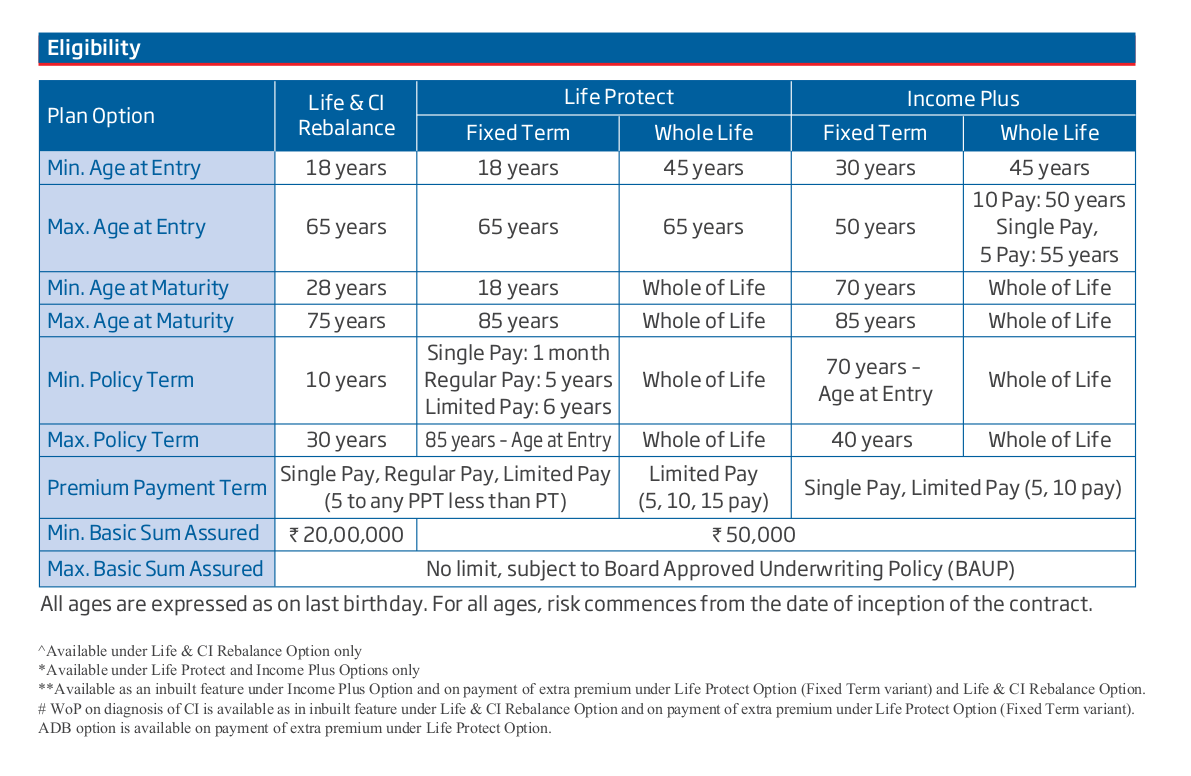

Eligibilty Criterion

How are these ages calculated?

- From your last birthday, that means even if you are 23 and 11 months old, the premium and start date will take in account only 23 years old).

Page 3 Explained :

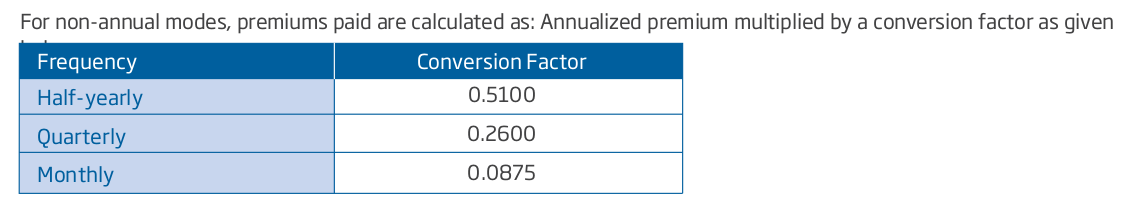

Conversion Factors

- Assume that your annual payment is 10,000 but you want to pay monthly or quarterly or annually.

- The amount paid depends on the conversion factor.

- Example : For monthly, you would have to pay

10,000 * 0.0875 = 850.

- Example : For monthly, you would have to pay

Possible Plans

- Life and CI Rebalance

- Life Protect

- Income Plus

Page 3 Onwards

Life and Critical Illness Rebalance Plan

Description :

Provides a smart cover that acts as a balance between death and critical illness benefits.What actually happens :

- At each year after you buy the policy, the life cover(amount that you would have got if you died now) decreases while the critical illness(amount that you would have got in case of cancer like disease) increases.

More in-depth Know-How :

Example :

Let say you choose that you need a cover(Basic Sum Assured) of 1 Crore at 25 years old and a policy term till you become 60 years old.Some terms :

1. Basic Sum Assured : B-SA 2. Life Cover Sum Assured: LC-SA 3. Critical Illness Sum Assured : CI-SA- At time of purchase, LC-SA will be

80 Lakhs(80% of B-SA)andd CI-SA will be20 Lakhs(20% of B-SA). At every policy anniversay, the LC-SA will decrease by

30% * BS-SA / Policy Termwhich comes out to be 85,714 and your CI-SA will increase by the same amount that is 85,714Death Benefit : (This isn't just your LC-SA)

It is the maximum of all below points.- Sum Assured on Death

- For single Pay : max(125% of single premium, sum assured on maturity)

- For regular Pay / Limited Pay : max(10 * annualized premium, sum assured on maturity)

- 105% of all premiums paid ( Which is quite low, 10,000 for 30 years makes just 3,00,000)

- LC-SA

- Sum Assured on Death

Critical Illness Benefit :

- This is plain simple CI-SA.

- All further premiums will be waived off and Life Cover Continues.

Maturity Benefit :

- Made available on survival at maturity date upon survival.

- Total Premiums paid till maturity date will be paid back, only if ROP(Return of Payment) is selected

- At time of purchase, LC-SA will be

Life Protect Plan

Description :

Provides just life cover and pays a lumpsum upon demise of the policy-holder.More in-depth Know-How :

Example :

Let say you choose that you need a cover(Basic Sum Assured) of 1 Crore at 25 years old and a policy term till you become 60 years old.Death Benefit : (This isn't just your LC-SA)

It is the maximum of all below points.

- Sum Assured on Death

- For single Pay : max(125% of single premium, sum assured on maturity, B-SA)

- For regular Pay / Limited Pay : max(10 * annualized premium, sum assured on maturity, B-SA)

- 105% of all premiums paid ( Which is quite low, 10,000 for 30 years makes just 3,00,000)

- Sum Assured on Death

Maturity Benefit :

- Made available on survival at maturity date upon survival.

- Total Premiums paid till maturity date will be paid back, only if ROP(Return of Payment) is selected

Income Plus Plan

Description :

Provides a life cover and pays a lumpsum upon demise of the policy-holder alongwith this upon survival it provides a regular monthly income from age 60 until maturity date decided by you or death(Whole Life Rider).

The money paid monthly is 0.1% of B-SA and it reduces your B-SA in the same proportion.

- Example if your B-SA was 1 cr then when you turn 61, you get

0.1% * 1cr * 12 = 1,20,000and your B-SA becomes1cr - 1,20,000 = 98,80,000

More in-depth Know-How :

Example :

Let say you choose that you need a cover(Basic Sum Assured) of 1 Crore at 25 years old and a policy term till you become 60 years old.Death Benefit : (This isn't just your LC-SA)

It is the maximum of all below points.

- Sum Assured on Death

- For single Pay : max(125% of single premium, sum assured on maturity, B-SA)

- For regular Pay / Limited Pay : max(10 * annualized premium, sum assured on maturity, B-SA)

- 105% of all premiums paid ( Which is quite low, 10,000 for 30 years makes just 3,00,000)

- Sum Assured on Death

Survival Benefit:

- 0.1% of B-SA each month from policy anniversary after your 60th birthday.

Maturity Benefit :

- For Fixed Term

- max(110% of total premiums paid - survival benefits paid, 0)

- For Whole Life

- NIL

- For Fixed Term

Add-Ons [Page 8 and 9]

Return of Premium (ROP)

- HDFC gives you a option to get all the money that you paid you over the years in form of premium, back as your policy matures.

Waiver of Premium CI (WOP CI)

- HDFC gives you the option to not give successive premiums if you are diagonosed with CI.

Accidental Death Benefit ( ADB )

- An extra 100% of B-SA is payable in case death is due to an accident.

Alteration of premium payment frequency

- HDFC gives you the option to change premium paying frequency without any charge/fee. You can choose between monthly, quarterly, annually.

- Note : Conversion Rates apply once you change premium frequency.

Option to reduce Premium Payment Term from Regular Pay to Limited Pay

- HDFC gives you option to convert the outstanding regular premiums into any limited premium period available under the plan options without any charge/ fee